Introduction

Financial literacy is the knowledge and skills needed to make informed decisions about money management, including saving, investing, and spending. Unfortunately, many people lack basic financial literacy, which can lead to poor financial decisions, debt, and financial insecurity. In this article, we will explore the importance of financial literacy, the consequences of financial illiteracy, and how to improve your financial literacy.

The Importance of Financial Literacy

Importance of Financial Literacy for Personal Finance

Financial literacy is important for personal finance because it allows individuals to make informed decisions about their money. This includes managing budgets, saving for retirement, and making investments. Without financial literacy, people may make poor financial decisions, such as overspending, taking on too much debt, or failing to save for the future.

Importance of Financial Literacy for Business Finance

Financial literacy is also essential for business finance. Business owners need to understand financial statements, cash flow management, and financial planning in order to run a successful business. Without financial literacy, business owners may struggle to make informed decisions, leading to financial difficulties and even bankruptcy.

Importance of Financial Literacy for the National Economy

Financial literacy is also important for the national economy. A lack of financial literacy can lead to a variety of economic problems, including financial crises, high levels of debt, and low levels of savings. When individuals and businesses are financially literate, they are better able to contribute to a healthy and stable economy.

The Consequences of Financial Illiteracy

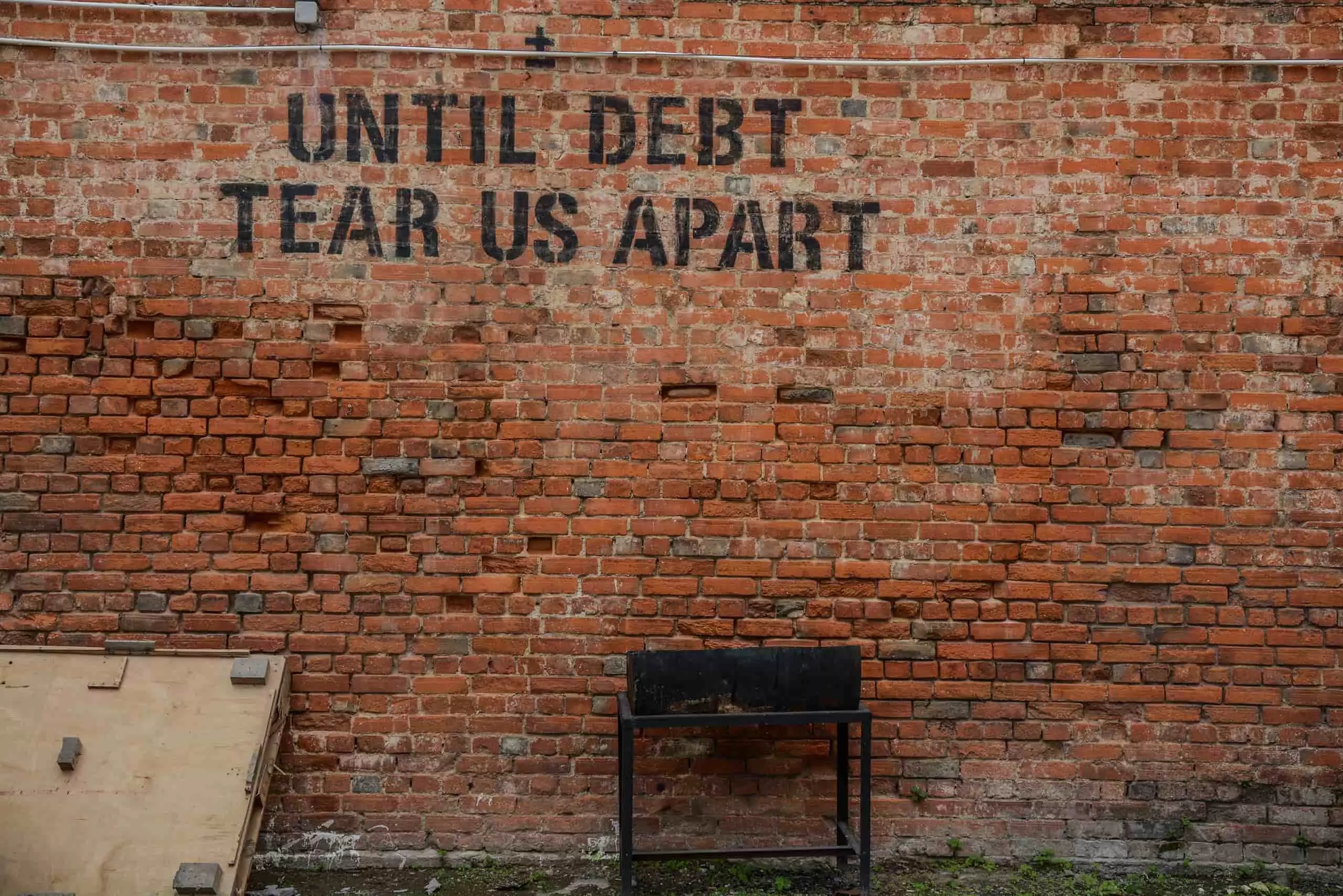

Debt

One of the most common consequences of financial illiteracy is debt. Without knowing the importance of financial literacy, people may take on too much debt or use credit cards irresponsibly, leading to high-interest rates and large amounts of debt that can be difficult to repay.

Low Savings

Financial illiteracy can also lead to low levels of savings. Without financial literacy, people may fail to save for the future, leading to economic insecurity and difficulty in retirement.

Poor Credit Scores

Financial illiteracy can also lead to poor credit scores. Without financial literacy, people may fail to make payments on time or use credit cards irresponsibly, leading to late payments and low credit scores.

Investment Losses

Financial illiteracy can also lead to investment losses. Without financial literacy, people may make poor investment decisions, leading to losses in the stock market or other investments. That’s why it is suggested to know about the importance of Financial Literacy.

How to Improve Your Financial Literacy?

Read Books and Articles

One of the best ways to improve your financial literacy and know its importance is to read books and articles about personal finance and investing. Many excellent books and articles can teach you the basics of financial literacy and help you make informed decisions about your money.

Take Classes or Workshops

Another way to improve your financial literacy is to take classes or workshops. Many community colleges and universities offer courses on personal finance and investing. You can also find workshops and seminars offered by financial advisors or investment firms.

Use Financial Planning Tools

There are many financial planning tools available online that can help you manage your money and make informed decisions about your finances. These tools can help you create a budget, track your expenses, and plan for the future.

Seek Professional Advice

If you are struggling with financial literacy, it may be helpful to seek professional advice and know the importance of financial literacy and why it is important. Financial advisors and investment professionals can help you make informed decisions about your money and create a financial plan that meets your needs.

Conclusion

Importance of Financial Literacy: Financial literacy is an essential skill that everyone should have. It allows individuals to make informed decisions about their money, run successful businesses, and contribute to a healthy and stable economy. Without financial literacy, people may struggle with debt, low savings, poor credit scores, and investment losses. By reading books and articles, taking classes or workshops, using financial planning tools, and seeking professional advice, you can improve your financial literacy and make informed decisions about your money. By taking the time to learn about personal finance and investing, you can avoid the consequences of financial illiteracy and create a secure financial future for yourself and your family. Remember, financial literacy is not just important for individuals, but for the economy as a whole. So, start improving your financial literacy today and take control of your financial future.

See also: Montessori Education: A Child-Centered Approach to Learning